vat tax refund france louis vuitton | chanel louis vuitton tax refund vat tax refund france louis vuitton The price of my bag in France was €1080 (€900 + 20% VAT of €180) compared to USD $1555.20 USD ($1440 retail price plus 8% California sales tax of $115.20). The amount claimed on the VAT refund is €180 but due . Dilated cardiomyopathy is a type of heart muscle disease that causes the heart chambers (ventricles) to thin and stretch, growing larger. It typically starts in the heart's main pumping chamber (left ventricle). Dilated cardiomyopathy makes it harder for the heart to pump blood to the rest of the body.

0 · wevat louis vuitton tax refund

1 · vat refund in paris

2 · louis vuitton va tax refund

3 · louis vuitton tax refund 2023

4 · louis vuitton shopping tax refund

5 · louis vuitton france tax refund

6 · france vat refund

7 · chanel louis vuitton tax refund

There is no actual evidence that Prometheus takes place on a different planet. There is a widely accepted "theory" that it takes place on LV-223 instead of the LV-426, but there is no hard evidence, other than word of mouth. Even if .

By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc.

Understanding the VAT tax refund process in Paris, France. What is the refund amount, how do you process the paperwork, and who qualifies for the VAT refund? In France, there’s two major companies that processes VAT refunds for retailers: Global Blue and Planet Tax Free (formally Premier Tax Free). In my experience, Global Blue is pretty fast and I get my VAT refund back within a couple of days.

The price of my bag in France was €1080 (€900 + 20% VAT of €180) compared to USD 55.20 USD (40 retail price plus 8% California sales tax of 5.20). The amount claimed on the VAT refund is €180 but due .

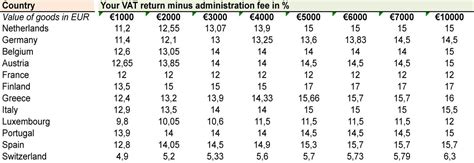

You just need to ask the shop to print the invoice with their name. It is super easy. You could get 80% tax refund which is higher than most of the other refund companies. Use the promo code to get additional 1% VAT refund on SkipTax ETCUZESC or click here to register Learn how to shop tax-free at Louis Vuitton and many other stores, and obtain a VAT refund in cities like Paris as a tourist. In France, for example, this kicks your refund down to around 12%, instead of the full 19.6% you’d get doing it the old-fashioned way. Who Qualifies for a VAT Refund? In most places, visitors in a country on a tourist visa are the primary group to .

By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc.Understanding the VAT tax refund process in Paris, France. What is the refund amount, how do you process the paperwork, and who qualifies for the VAT refund? In France, there’s two major companies that processes VAT refunds for retailers: Global Blue and Planet Tax Free (formally Premier Tax Free). In my experience, Global Blue is pretty fast and I get my VAT refund back within a couple of days.

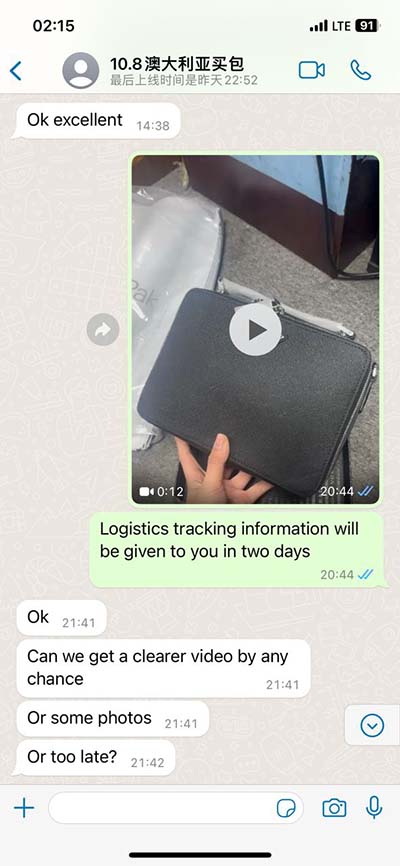

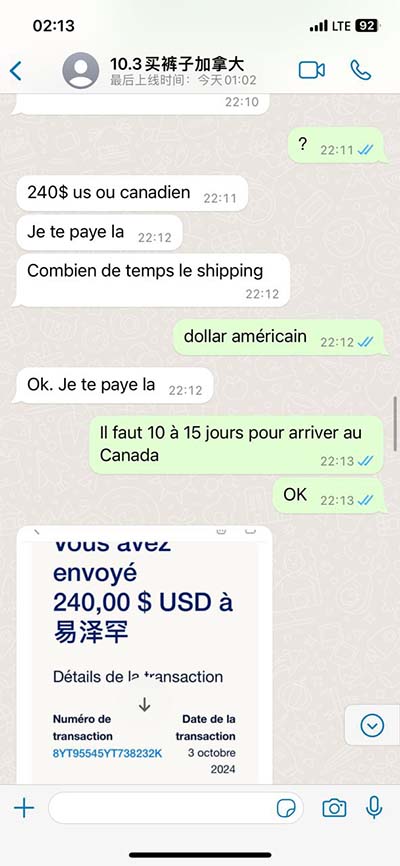

The price of my bag in France was €1080 (€900 + 20% VAT of €180) compared to USD 55.20 USD (40 retail price plus 8% California sales tax of 5.20). The amount claimed on the VAT refund is €180 but due to the processing fee, I received €129.60 as a refund.You just need to ask the shop to print the invoice with their name. It is super easy. You could get 80% tax refund which is higher than most of the other refund companies. Use the promo code to get additional 1% VAT refund on SkipTax ETCUZESC or click here to register Learn how to shop tax-free at Louis Vuitton and many other stores, and obtain a VAT refund in cities like Paris as a tourist. The best way to maximize your VAT refund is on larger purchases like luxury items or a group of items at one store. Buy something made in the country you’re visiting. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Travel with family.

This service is only available for clients with a valid billing address within the 9 European coutries covered by this website and a matching credit card nationality. Tax free claims will therefore not be eligible for orders placed online or over the phone, including Click & Collect. I know I can apply for a VAT refund of 12% with Paris customs when I leave Paris, but I am unclear if I have to pay taxes on those items when I return to the US? I am guessing they need to be be declared to US customs, but then what?

wevat louis vuitton tax refund

In France, for example, this kicks your refund down to around 12%, instead of the full 19.6% you’d get doing it the old-fashioned way. Who Qualifies for a VAT Refund? In most places, visitors in a country on a tourist visa are the primary group to .By getting a VAT refund with the Wevat tax refund app, you can expect to save up to 13% on your purchases! Here’s what you need to know before shopping and a guide on how to get a tax refund for purchases from luxury fashion retailers like Louis Vuitton, Chanel, etc.Understanding the VAT tax refund process in Paris, France. What is the refund amount, how do you process the paperwork, and who qualifies for the VAT refund? In France, there’s two major companies that processes VAT refunds for retailers: Global Blue and Planet Tax Free (formally Premier Tax Free). In my experience, Global Blue is pretty fast and I get my VAT refund back within a couple of days.

givenchy nightingale goatskin

The price of my bag in France was €1080 (€900 + 20% VAT of €180) compared to USD 55.20 USD (40 retail price plus 8% California sales tax of 5.20). The amount claimed on the VAT refund is €180 but due to the processing fee, I received €129.60 as a refund.You just need to ask the shop to print the invoice with their name. It is super easy. You could get 80% tax refund which is higher than most of the other refund companies. Use the promo code to get additional 1% VAT refund on SkipTax ETCUZESC or click here to register

Learn how to shop tax-free at Louis Vuitton and many other stores, and obtain a VAT refund in cities like Paris as a tourist.

givenchy official facebook

vat refund in paris

The best way to maximize your VAT refund is on larger purchases like luxury items or a group of items at one store. Buy something made in the country you’re visiting. Purchasing a Louis Vuitton purse in France will save you a significant amount of money compared to buying the same purse in the United States. Travel with family.This service is only available for clients with a valid billing address within the 9 European coutries covered by this website and a matching credit card nationality. Tax free claims will therefore not be eligible for orders placed online or over the phone, including Click & Collect.

louis vuitton va tax refund

[Yu-Gi-Oh! Duel Links] How to Farm Level 40 Kaiba 7000-8000 | Full Farming Session. gunsblazing. 169K subscribers. 2.9K. 432K views 6 years ago. Hey people, I didn't have time to edit/process.

vat tax refund france louis vuitton|chanel louis vuitton tax refund